News

₹200 Per Day to ₹28 Lakh: LIC Jeevan Pragati’s Incredible Investment Plan

The LIC Jeevan Pragati Scheme is an attractive insurance policy designed to provide both financial security and savings benefits. Launched by the Life Insurance Corporation of India (LIC) on February 3, 2016, this non-linked, with-profits endowment plan aims to cater to the needs of individuals looking for a reliable investment option that also offers life coverage. With its unique features and benefits, the Jeevan Pragati Scheme has gained popularity among policyholders who want to secure their future while also accumulating wealth.

This policy is particularly appealing because it allows individuals to invest a small amount daily and reap significant returns over time. For instance, by investing just ₹200 per day, policyholders can accumulate a maturity benefit of approximately ₹28 lakhs. This makes the Jeevan Pragati Scheme not only a means of securing life insurance but also a smart investment choice for long-term financial planning.

In this article, we will explore the various aspects of the LIC Jeevan Pragati Scheme, including its features, benefits, eligibility criteria, and more. Whether you are considering investing in this policy or simply want to learn more about it, this comprehensive guide will provide you with all the necessary information.

LIC Jeevan Pragati Scheme: Overview

The LIC Jeevan Pragati Scheme offers a combination of life insurance and savings, making it an ideal choice for individuals who want to ensure their family’s financial security while also building a corpus for future needs. Below is an overview of the key features and details of this scheme.

| Feature | Details |

|---|---|

| Type of Plan | Non-linked with-profits endowment plan |

| Minimum Age of Entry | 12 years |

| Maximum Age of Entry | 45 years |

| Policy Term | 12 to 20 years |

| Minimum Sum Assured | ₹1.5 lakhs |

| Maximum Sum Assured | No limit (in multiples of ₹10,000) |

| Premium Payment Frequency | Monthly, Quarterly, Bi-Annually, Annually |

| Maturity Age | Up to 65 years |

Key Features of LIC Jeevan Pragati Scheme

- Automatic Increase in Coverage: The risk cover increases automatically every five years during the policy term. This feature helps keep pace with inflation and ensures that the policyholder’s family is adequately protected.

- Death Benefit: In case of the policyholder’s death during the policy term, the nominee receives:

- Sum Assured on Death

- Accrued Simple Reversionary Bonuses

- Final Additional Bonus (if applicable)

- Maturity Benefit: If the policyholder survives until maturity and has paid all premiums regularly, they receive:

- Basic Sum Assured

- Vested Simple Reversionary Bonuses

- Final Additional Bonus (if applicable)

- Loan Facility: The policyholder can avail of loans against the policy after three years of premium payment, providing liquidity when needed.

- Tax Benefits: Premiums paid under this scheme are eligible for tax deductions under Section 80C of the Income Tax Act. Additionally, both death benefits and maturity benefits are tax-free under Section 10(10D).

- Rider Options: Policyholders can enhance their coverage by adding riders such as Accidental Death and Disability Benefit.

Benefits of LIC Jeevan Pragati Scheme

The LIC Jeevan Pragati Scheme provides several benefits that make it an attractive option for potential investors:

- Financial Security: The primary advantage is the financial security it offers to the family in case of the policyholder’s untimely demise.

- Wealth Accumulation: The scheme allows individuals to save systematically over time, leading to substantial returns upon maturity.

- Flexible Premium Payment Options: With various premium payment frequencies available, policyholders can choose what best suits their financial situation.

- Participation in Profits: The plan allows policyholders to participate in profits through bonuses declared by LIC.

- Surrender Value: After three years of premium payments, policyholders can surrender their policies for a guaranteed surrender value if they choose not to continue.

Eligibility Criteria for LIC Jeevan Pragati Scheme

To enroll in the LIC Jeevan Pragati Scheme, individuals must meet certain eligibility criteria:

- Age Requirement: The minimum age for entry is 12 years, while the maximum age is 45 years.

- Sum Assured Limitations: The minimum sum assured is ₹1.5 lakhs with no upper limit.

- Policy Term Options: Individuals can select a policy term ranging from 12 to 20 years.

Premium Calculation Example

Assuming an individual decides to invest ₹200 daily in this scheme:

- Daily Investment = ₹200

- Monthly Investment = ₹200 * 30 = ₹6,000

- Annual Investment = ₹6,000 * 12 = ₹72,000

By consistently investing this amount over a period (let’s say 20 years), one could accumulate approximately ₹28 lakhs at maturity due to bonuses and returns generated by LIC.

How Does It Work?

The process of enrolling in and benefiting from the LIC Jeevan Pragati Scheme involves several steps:

- Application Process: Interested individuals can apply online or visit their nearest LIC branch.

- Documentation Required:

- Identity Proof (Aadhaar card, PAN card)

- Address Proof (Utility bill or bank statement)

- Age Proof (Birth certificate or school certificate)

- Payment of Premiums: Once enrolled, timely payment of premiums is essential to maintain coverage.

- Claim Process:

- In case of death during the term or at maturity, beneficiaries must submit necessary documents like death certificates and identity proofs for claims.

Exclusions Under LIC Jeevan Pragati Scheme

While the LIC Jeevan Pragati Scheme offers extensive coverage, certain exclusions apply:

- Claims may be void if death occurs due to suicide within one year from purchasing or reviving the policy.

- Death caused by participating in illegal activities or criminal acts is not covered.

- Accidental death claims may be denied if caused by intoxication or drug influence.

Conclusion

The LIC Jeevan Pragati Scheme stands out as a reliable option for those seeking both life insurance and savings benefits. With its automatic increase in coverage every five years and significant maturity benefits, it caters well to individuals looking for long-term financial security while ensuring that their loved ones are protected.

By investing as little as ₹200 daily, one can secure a future worth approximately ₹28 lakhs upon maturity, making it an appealing choice for many families across India. Whether you are new to insurance or looking to enhance your portfolio with a robust plan like this one, understanding its features and benefits will help you make informed decisions about your financial future.

News

EPFO 2025: 3 Major Rule Changes That Will Impact PF Withdrawal and Pensio

The Employees’ Provident Fund Organisation (EPFO) plays a crucial role in the financial security of millions of employees in India. It provides a savings scheme that helps workers accumulate funds for retirement. As we move into 2025, EPFO is set to introduce significant changes that will transform how subscribers access their Provident Fund (PF) and pension benefits. These changes aim to enhance convenience, accessibility, and efficiency for all users.

In recent years, the EPFO has been working towards digitizing its processes and making them more user-friendly. The upcoming modifications are a continuation of this trend, focusing on providing members with better control over their finances. With the introduction of new rules and features, employees will find it easier to manage their PF accounts, withdraw funds, and receive pensions. This article will explore the key changes expected in 2025 and how they will impact subscribers.

The following sections will detail the major updates to EPFO regulations, including the introduction of ATM withdrawals, simplified pension processes, and other enhancements designed to improve user experience. Understanding these changes is essential for all EPFO members, as they will significantly affect how funds are accessed and managed.

EPFO 2025: Key Changes to PF Withdrawals and Pension Access

The year 2025 marks a pivotal moment for EPFO subscribers as several new rules come into effect. These rules are designed to streamline processes, reduce paperwork, and provide greater flexibility in accessing funds. Below is an overview of the main changes that will impact how members interact with their EPF accounts.

| Feature | Description |

|---|---|

| ATM Withdrawals | Subscribers can withdraw PF funds using ATM cards 24/7. |

| Simplified Pension Withdrawals | Pensioners can access their pensions from any bank without additional verification. |

| Digital Processes | Reduction in paperwork for account management and withdrawals. |

| Increased Accessibility | Enhanced access to PF accounts through digital platforms. |

| Equity Investment Options | EPFO may reinvest a portion of ETF redemption earnings into stocks. |

| Centralized Pension Payment | Members can withdraw pensions from any bank branch across India. |

ATM Withdrawals: Instant Access to Funds

One of the most exciting changes coming in 2025 is the introduction of ATM cards for EPF subscribers. This feature allows members to withdraw their Provident Fund money directly from ATMs at any time, providing instant access to their savings without the need for lengthy processing times. Previously, members had to wait several days for their withdrawal requests to be processed and transferred to their bank accounts. With this new system, withdrawals can be made 24/7, making it much more convenient for users.

Simplified Pension Withdrawals

Another significant change is the simplification of pension withdrawals. Starting in 2025, pensioners will be able to withdraw their pensions from any bank branch without needing additional verification processes. This change aims to save time and enhance flexibility for pensioners across India. By removing bureaucratic hurdles, the EPFO is ensuring that retirees can access their funds quickly and efficiently.

Digital Processes: Reducing Paperwork

The move towards digital processes is set to minimize paperwork and manual intervention in managing EPF accounts. Subscribers will benefit from a more streamlined experience when it comes to account management and fund withdrawals. This digital transformation aligns with broader trends in financial services aimed at enhancing user experience through technology.

Increased Accessibility: Managing Funds with Ease

With these changes, accessibility will be greatly improved for all EPFO members. The introduction of user-friendly digital platforms means that subscribers can easily manage their accounts online without needing to visit physical offices or rely on intermediaries. This shift not only saves time but also empowers users by giving them greater control over their retirement savings.

Equity Investment Options: Boosting Returns

To enhance returns on investments, EPFO is considering reinvesting a portion of its Exchange-Traded Fund (ETF) redemption earnings back into stocks and other assets. This potential move could lead to higher returns for subscribers’ PF accounts, contributing positively to their retirement savings over time.

Centralized Pension Payment System

The new Centralized Pension Payment System (CPPS) allows members of the Employee Pension Scheme (EPS) to withdraw pensions from any bank branch across India starting January 1, 2025. This system aims to simplify pension disbursement and ensure that retirees have easy access to their funds regardless of where they bank.

Conclusion: Embracing Change in EPFO

As we look forward to 2025, these new rules signify a transformative period for the Employees’ Provident Fund Organisation and its subscribers. The focus on accessibility, efficiency, and user empowerment reflects a commitment to improving the financial well-being of employees across India.

By implementing these changes, EPFO is not only enhancing the experience for current subscribers but also setting a foundation for future improvements in retirement savings management. As employees become more aware of these updates, they will be better equipped to take advantage of the benefits offered by the EPFO.

In summary, the upcoming changes in 2025 will fundamentally alter how members interact with their Provident Fund accounts and pensions. With features like ATM withdrawals, simplified processes, and increased accessibility, subscribers can look forward to a more efficient and user-friendly experience as they plan for their financial futures.

Technology

Get Ready for Redmi 14C 5G: 12GB RAM, 5160mAh Battery, and More Features Coming Soon

Xiaomi is set to launch its latest smartphone, the Redmi 14C 5G, in India on January 6, 2025. This new device aims to capture the attention of tech enthusiasts and everyday users alike with its impressive specifications, including a massive 5160mAh battery and the capability to support up to 12GB of RAM. The Redmi series has always been known for offering great value for money, and the Redmi 14C is expected to continue this trend with its powerful features and competitive pricing.

The Redmi 14C 5G is designed not only for performance but also for aesthetics. It boasts a unique “Starlight” design that reflects the beauty of the cosmos, available in multiple color options such as light blue, black, and a dual-tone grey and dark blue. With a focus on delivering a high-quality user experience, Xiaomi has integrated advanced technology into this device, ensuring it meets the demands of modern smartphone users.

In this article, we will explore the key specifications, features, and expected performance of the Redmi 14C 5G, providing potential buyers with all the information they need before its launch.

Redmi 14C 5G: An Overview

The Redmi 14C 5G is packed with features that make it a strong contender in the budget smartphone market. Below is a comprehensive overview of its specifications:

| Feature | Details |

|---|---|

| Display | 6.88-inch HD+ (720×1640) |

| Processor | MediaTek Helio G81 |

| RAM Options | Up to 12GB |

| Storage Options | Up to 256GB (expandable via microSD) |

| Rear Camera | 50MP primary camera |

| Front Camera | 13MP selfie camera |

| Battery Capacity | 5160mAh |

| Charging Speed | 18W fast charging |

| Operating System | Android 14-based HyperOS |

Key Features of Redmi 14C

- Display Quality: The Redmi 14C features a large 6.88-inch display with a resolution of 720×1640 pixels, providing an immersive viewing experience perfect for media consumption.

- Performance: Powered by the MediaTek Helio G81 processor, this device ensures smooth performance for everyday tasks and gaming.

- Camera Capabilities: The smartphone includes a robust 50MP rear camera, allowing users to capture high-quality images with AI enhancements. The front camera is equipped with a 13MP sensor, ideal for selfies.

- Battery Life: With a substantial 5160mAh battery, users can expect extended usage without frequent recharging. The phone also supports 18W fast charging, which helps in quickly powering up the device.

- Connectivity Options: The device supports dual SIM functionality with dual 5G support, ensuring users can take advantage of faster network speeds.

Design and Build Quality

The design of the Redmi 14C is both modern and stylish. It features:

- A sleek body that measures approximately 171.88 x 77.80 x 8.22 mm, making it comfortable to hold.

- A weight of around 211 grams, which is manageable for daily use.

- Multiple color options that cater to different tastes, including Dreamy Purple, Midnight Black, Sage Green, and Starry Blue.

Software Experience

Running on Android 14 with Xiaomi’s custom HyperOS, the Redmi 14C promises an intuitive user interface along with various customization options. This operating system enhances multitasking capabilities and improves overall performance.

Performance Specifications

To further understand what makes the Redmi 14C stand out in terms of performance, let’s delve into its specifications:

- The device will feature configurations ranging from 4GB to up to 12GB of RAM, allowing users to choose based on their multitasking needs.

- Storage options will include variants with up to 256GB internal storage, expandable via microSD card for additional space.

Camera System

The camera system on the Redmi 14C is designed to cater to photography enthusiasts:

- The rear camera setup includes a primary 50MP sensor that captures detailed images even in low light conditions due to its f/1.8 aperture.

- Additional features such as HDR and AI enhancements allow for better image processing.

- The front-facing camera offers a resolution of 13MP, equipped with night mode capabilities for improved selfies in dim lighting.

Battery Performance

One of the standout features of the Redmi 14C is its battery life:

- With a capacity of 5160mAh, users can expect up to 21 days of standby time or around 42 hours of voice calls.

- The inclusion of an efficient battery management system ensures longevity and safety during charging.

Connectivity Features

The Redmi 14C includes various connectivity options:

- Supports dual SIM functionality (Nano-SIM) allowing users to manage two numbers seamlessly.

- Connectivity features include Wi-Fi, Bluetooth v5.3, GPS, NFC (region dependent), and USB Type-C port for charging and data transfer.

Additional Features

The phone also comes equipped with several sensors including:

- Accelerometer

- Ambient light sensor

- Proximity sensor

- Fingerprint sensor for enhanced security

- Face unlock feature for quick access

Conclusion

In summary, the upcoming launch of the Redmi 14C 5G on January 6, 2025, promises an exciting addition to Xiaomi’s lineup of smartphones. With its impressive specifications such as up to 12GB RAM, a powerful battery capacity of 5160mAh, and advanced camera features, it aims to deliver exceptional value at an affordable price point.

As consumers await its release, the anticipation builds around how well this device will perform in real-world scenarios compared to competitors in its class. Whether you are looking for a reliable smartphone for daily use or something that can handle more demanding tasks, the Redmi 14C could be worth considering once it hits the market.

This article has provided an overview of what potential buyers can expect from the Redmi 14C upon its launch. With its blend of performance, design, and affordability, it stands poised to make waves in the Indian smartphone market in early January.

News

Glowing Skin in 10 Days: Try This Cumin, Mint, and Cucumber Drink Daily

Skin care is an essential part of maintaining healthy and radiant skin. Many people seek natural remedies to enhance their skin’s glow, and one effective approach is through the consumption of specific drinks made from natural ingredients. Among these, a refreshing drink made from cucumber, mint, and cumin has gained popularity for its skin benefits. This article will explore how this drink can help achieve a natural glow, along with expert recipes and tips.

The combination of cucumber, mint, and cumin not only refreshes the body but also provides numerous benefits for the skin. Cucumber is known for its high water content, which helps keep the skin hydrated. Mint adds a cooling effect and can soothe irritated skin, while cumin is rich in antioxidants that fight free radicals, promoting healthier skin. Incorporating this drink into your daily routine can significantly enhance your skin’s appearance and overall health.

In this article, we will delve into the details of making this glowing skin drink, its benefits, and how it works to improve your skin’s texture and tone. We will also provide a comprehensive overview of the key ingredients involved in this recipe.

Skin Care Tips: जीरा, पुदीना और खीरे की ड्रिंक से पाएं स्किन पर नेचुरल ग्लो

Overview of Key Ingredients

| Ingredient | Benefits |

|---|---|

| Cucumber | Hydrates the skin, reduces swelling, and provides vitamins A and C. |

| Mint | Soothes irritated skin, has anti-inflammatory properties, and adds freshness. |

| Cumin | Rich in antioxidants, helps detoxify the body, and improves blood circulation. |

| Lemon | Brightens the skin, provides vitamin C, and helps in detoxification. |

| Ginger | Improves blood circulation and has anti-inflammatory properties. |

| Salt | Enhances flavor and can help retain moisture in the skin when used properly. |

Benefits of Cucumber-Mint-Cumin Drink

- Hydration: Cucumber is composed of about 95% water, making it an excellent choice for keeping the skin hydrated.

- Detoxification: The drink aids in flushing out toxins from the body, which can lead to clearer skin.

- Anti-inflammatory Properties: Mint and ginger help reduce inflammation, which can alleviate redness and irritation.

- Nutrient-Rich: This drink is packed with vitamins and minerals that nourish the skin from within.

- Improved Blood Circulation: Cumin enhances blood flow to the skin, promoting a healthy glow.

How to Prepare the Cucumber-Mint-Cumin Drink

To make this refreshing drink for glowing skin, follow these simple steps:

Ingredients Needed

- Cucumber: 1 medium-sized

- Mint leaves: 4-5 fresh leaves

- Cumin seeds: ½ teaspoon

- Ginger: 2 small pieces

- Lemon juice: ½ lemon

- Salt: 1 teaspoon (optional)

Preparation Steps

- Wash all ingredients thoroughly to remove any dirt or pesticides.

- Peel the cucumber, if desired, and chop it into small pieces.

- In a blender, add chopped cucumber, mint leaves, cumin seeds, ginger pieces, lemon juice, and salt.

- Blend all ingredients until smooth.

- Pour the mixture into a glass and strain it if you prefer a smoother texture.

- Serve immediately for maximum freshness.

Tips for Incorporating This Drink into Your Routine

- Morning Boost: Start your day with this drink on an empty stomach for better absorption of nutrients.

- Post-Workout Refreshment: Enjoy it after exercising to replenish lost fluids.

- Detox Days: Use this drink as part of a detox plan to cleanse your system.

Additional Skin Care Tips

To complement your efforts in achieving glowing skin through this drink, consider these additional tips:

- Stay Hydrated: Drink plenty of water throughout the day to maintain hydration levels.

- Balanced Diet: Include fruits and vegetables rich in vitamins A, C, and E in your meals.

- Regular Exercise: Engage in physical activities to improve blood circulation and promote healthy skin.

- Skincare Routine: Follow a consistent skincare routine that includes cleansing, toning, and moisturizing.

Conclusion

Incorporating a cucumber-mint-cumin drink into your daily routine can be an effective way to achieve naturally glowing skin. This refreshing beverage not only hydrates but also detoxifies the body while providing essential nutrients that nourish the skin from within. By combining this drink with other healthy habits such as staying hydrated, eating a balanced diet, exercising regularly, and maintaining a proper skincare routine, you can enhance your overall skin health.

By following these tips and enjoying this delicious drink regularly, you are on your way to achieving radiant and healthy skin that glows from within!

-

Business1 year ago

Business1 year agoMyAccessFlorida Login: Easy Portal Guide & Troubleshooting Tips

-

Technology1 year ago

Technology1 year agoDGme Login Guide: Accessing Your Dollar General Employee Portal

-

How To12 months ago

How To12 months agoDirect2HR Login: Step by Step Portal Guide 2024

-

Events2 years ago

Events2 years agoTone Welch And Terry Are Still An Item. ,”Markaisha Is Based On A Genuine Person.”

-

Popular1 year ago

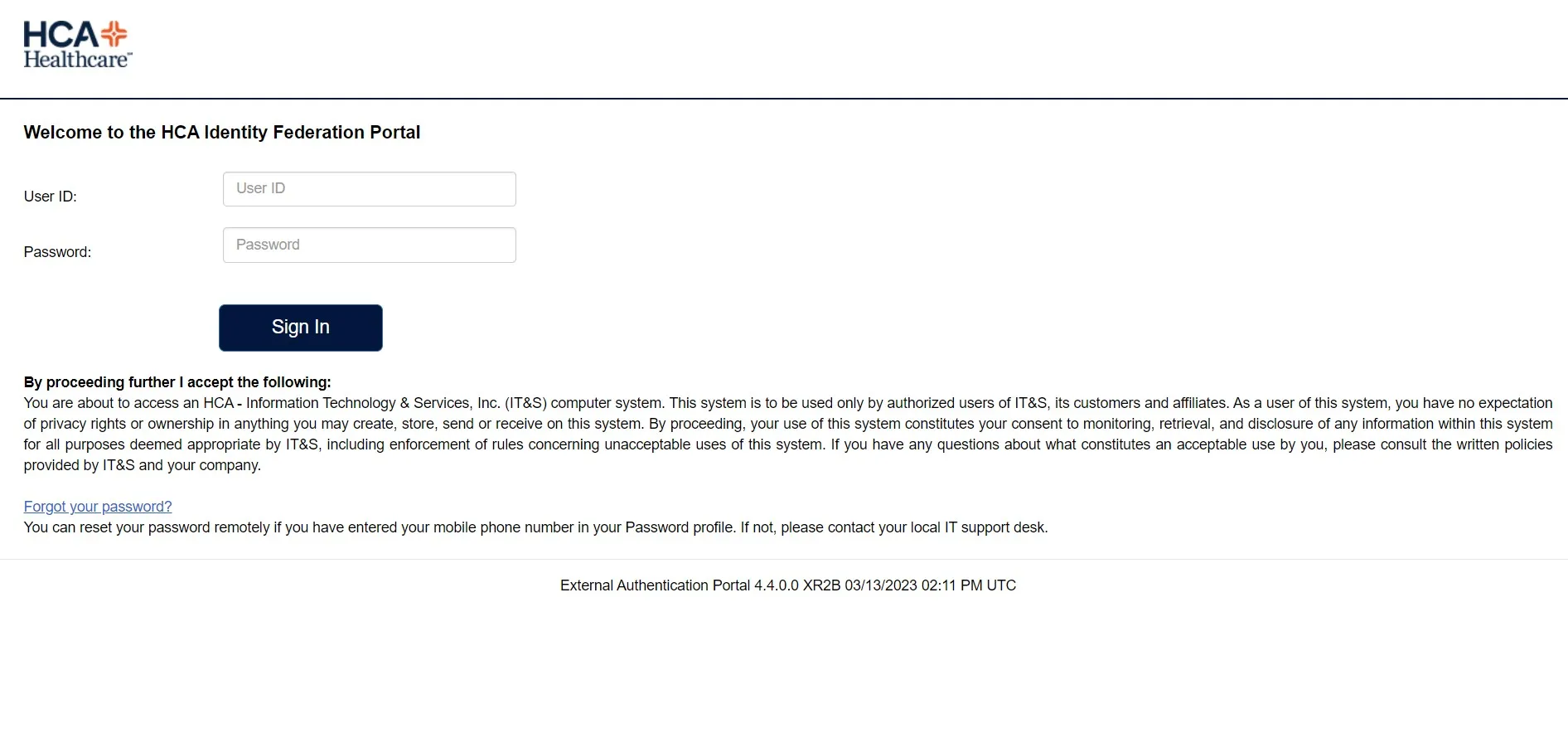

Popular1 year agoHCAHrAnswers Login Guide: Access Tips & FAQs

-

Popular12 months ago

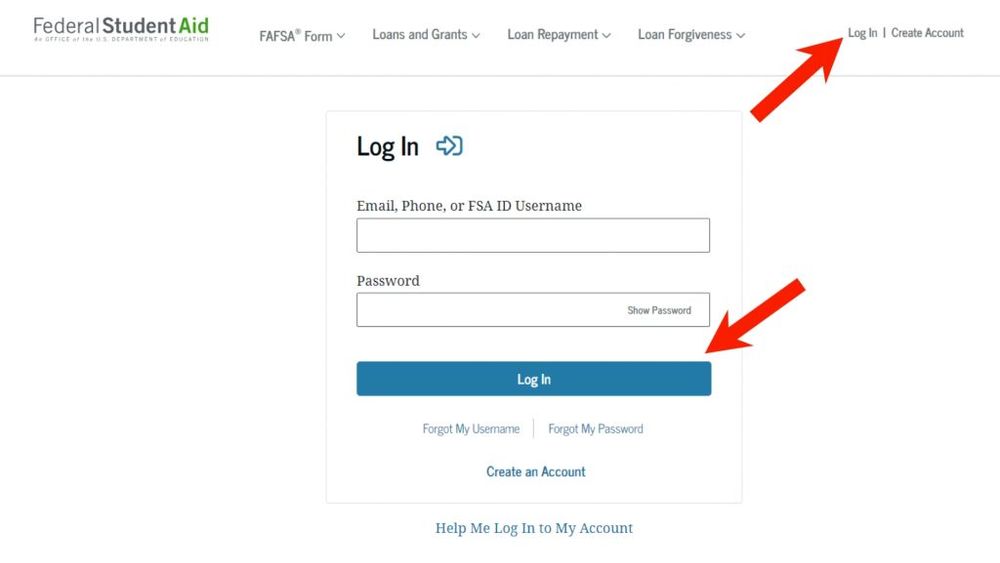

Popular12 months agoMyFedLoan Login: Managing Student Loan Portal 2024

-

Technology1 year ago

Technology1 year agoIos Screen Recorder Guide ( Don’t Know How To Record Screen On IPhone Or IPad? )

-

Celebrity2 years ago

Celebrity2 years agoSurya Kumar Yadav: You Can Learn A Lot From His Life Struggles